Private Security Agency License (PSARA License)

How to Issue GST Bill in Security Agency Business?

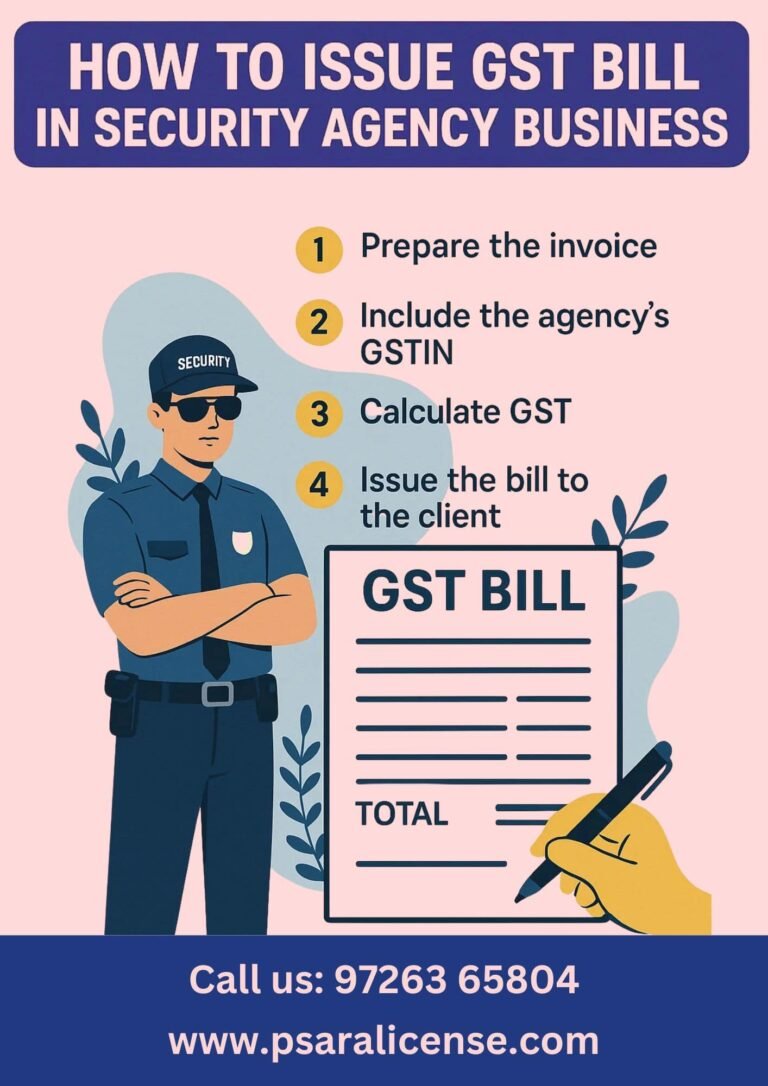

Welcome to our blog How to Issue GST Bill in Security Agency Business? Issuing a GST bill in a security agency is simple once you know the key steps. Every bill must include details like your agency’s name, GSTIN, client details, service description, invoice number, date, and the applicable GST rate. First, ensure your security agency is registered under GST if your turnover exceeds the threshold. Then, generate a clear invoice for each service provided, showing the GST charged separately. Regularly file your GST returns (like GSTR-1) to report these invoices and stay compliant. Following these steps not only keeps your business legal but also builds trust with your clients.

GST Registration Requirement for Security Agencies

Before issuing a GST bill, it’s important for a security agency to know if it needs GST registration. Generally, if your agency’s annual turnover exceeds the prescribed limit (currently ₹20 lakh for most states, ₹10 lakh for special category states), you must register for GST. Even if your turnover is below this threshold, registration can be beneficial as it allows you to claim input tax credit and work with clients who prefer dealing with GST-registered vendors. Certain clients, especially corporate or government entities, may insist on dealing only with GST-registered agencies, so having GST registration can open more business opportunities.

Once registered, your agency will receive a unique GSTIN (Goods and Services Tax Identification Number), which must be mentioned on every invoice you issue. Without GST registration, you cannot charge GST legally, and issuing bills with GST can attract penalties. Registration also requires maintaining proper records of all services, invoices, and GST collected, which makes your business operations more organized and transparent. By being GST-compliant, you not only avoid legal troubles but also build credibility and trust with your clients, ensuring smooth business transactions and long-term growth.

Importance of GST Compliance for Security Agencies

GST compliance is essential for security agencies to operate legally and avoid penalties or legal issues. By following GST rules—such as registering properly, issuing correct invoices, and filing timely returns—you ensure your business runs smoothly and maintains a good reputation. Clients, especially corporate and government organizations, prefer working with agencies that are GST-compliant, as it shows professionalism and transparency in business dealings. Non-compliance can lead to fines, interest on unpaid taxes, and even legal complications, which can harm your agency’s credibility and financial health.

Another key benefit of GST compliance is the ability to claim input tax credit on eligible purchases, such as security equipment, uniforms, training expenses, and office supplies. This reduces your overall tax liability and improves cash flow. Additionally, GST compliance helps in maintaining proper financial records, making audits and assessments easier, and enhancing trust with clients and partners. By staying GST-compliant, your security agency not only avoids legal troubles but also positions itself as a professional, reliable, and growth-ready business in a competitive market.

Key Components of a GST Invoice for Security Services

A GST invoice is not just a bill—it’s a legal document that ensures transparency and compliance with tax laws. Issuing a proper invoice protects your agency from disputes and helps in smooth GST return filing.

A proper GST invoice for security services must include the following details:

Supplier Details and GSTIN – Your agency’s name, address, and GST Identification Number.

Invoice Number and Date – A unique sequential invoice number and the date of issue.

Customer Details – Name, address, and GSTIN (if registered) of the client.

Description of Services – Clear description of the services provided, such as manpower security, surveillance, or other security solutions.

Taxable Value – The value of services on which GST is applicable.

GST Rate and Amount – The applicable GST rate (CGST, SGST/UTGST, or IGST) and the tax amount charged.

Total Invoice Amount – Total payable by the client, including the GST.

Terms of Payment (Optional but Recommended) – Payment due date, mode of payment, and any other conditions.

Mandatory Details to Include in the GST Bill

When issuing a GST bill for security services, certain details are legally required to ensure the invoice is valid and compliant with GST regulations. Including these details not only keeps your business on the right side of the law but also makes your billing process clear and professional for clients.

A proper GST bill must include the following mandatory details:

Business Name and GSTIN – Your agency’s registered name and unique GST Identification Number.

Invoice Number and Date – A unique sequential invoice number along with the date of issue.

Name and Address of the Client – Complete details of the customer receiving the services.

Description of Security Services Provided – Clear details of the services offered, such as armed security, surveillance, or event security.

Taxable Amount and Applicable GST – The value of services and the GST charged (CGST, SGST/UTGST, or IGST as applicable).

Total Amount Payable – The final amount including GST that the client must pay.

Steps to Generate a GST Bill Correctly

Generating a GST bill correctly is crucial for compliance and smooth business operations in a security agency. A properly issued invoice ensures transparency, avoids disputes, and helps in accurate GST return filing. Here’s a step-by-step process to create a GST-compliant bill:

Ensure GST Registration – Make sure your security agency is registered under GST and has a valid GSTIN. Without registration, you cannot legally issue GST invoices.

Collect Client Details Accurately – Gather the client’s name, address, and GSTIN (if registered) to include in the invoice. Accurate client information is essential for compliance and future record-keeping.

Calculate Taxable Value and GST Correctly – Determine the service charges and apply the correct GST rate (CGST, SGST/UTGST, or IGST). Ensure the calculations are precise to avoid errors or penalties.

Generate the Invoice – Use accounting or invoicing software for efficiency, or create it manually in a clear and professional format. Include all mandatory details such as invoice number, date, description of services, taxable value, GST amount, and total payable.

Send and Maintain Records – Share the invoice with your client promptly and keep a copy for your records. Proper record-keeping helps during audits, GST return filing, and resolving any client queries.

GST Return Filing for Security Agencies

For a security agency, filing GST returns is just as important as issuing invoices. Every invoice you generate must be reported to the GST department to maintain compliance. Security agencies are required to file GSTR-1, which includes details of all outward supplies (services provided to clients). This return can be filed monthly or quarterly, depending on your turnover and filing preference. Accurate reporting in GSTR-1 ensures your clients can also claim their input tax credit smoothly.

In addition to GSTR-1, agencies must file GSTR-3B, which is a summary return where you declare your total sales, input tax credit, and net GST payable. Filing both returns on time not only helps you stay compliant but also avoids interest, penalties, and late fees. Timely GST return filing builds credibility, keeps your tax records clean, and ensures your agency can claim eligible input tax credit on business-related expenses such as uniforms, office rent, or security equipment.

Tips for Maintaining Accurate Records

Maintaining accurate records is vital for GST compliance and smooth business management in a security agency. Here are some practical tips to help you stay organized:

Maintain a Register of All Issued Invoices – Record every invoice systematically with invoice number, date, client details, and GST amount.

Use Digital Accounting Software – Adopt GST-compatible billing or accounting software to generate invoices, track payments, and reduce manual errors.

Reconcile Invoices with Client Payments Monthly – Regularly match invoices with received payments to identify pending dues or mismatches early.

Keep Records for at Least 6 Years – As per GST rules, preserve invoices, payment receipts, and GST returns for six years for future reference or audits.

Organize Input Tax Credit Records – Maintain proper documentation of all expenses where GST is paid, so you can claim input tax credit without issues.

Back Up Your Data Regularly – Store digital copies of invoices and returns securely in cloud storage or external drives for added safety.

Contact Experts for Hassle-Free GST Billing

Managing GST compliance can sometimes feel confusing, especially with regular invoicing, return filing, and record-keeping. Any small mistake in billing or late filing of returns may lead to penalties or extra costs for your security agency. That’s why getting professional help can save you both time and effort, while also ensuring that everything is done correctly as per the rules.

GST experts can guide you through every step—whether it is GST registration, preparing accurate invoices, or filing monthly/quarterly returns. With their support, you can focus on running your security agency smoothly without worrying about tax complications. Professional assistance ensures your agency remains fully compliant, avoids legal troubles, and builds trust with clients.

📞 Contact: +91 97263 65804 | 🌐 Website: psaralicense.com

Gandhinagar Based Our PSARA Clients