Private Security Agency License (PSARA License)

How Reverse Charge Mechanism Works in Security Agency GST Billing ?

ChatGPT said:

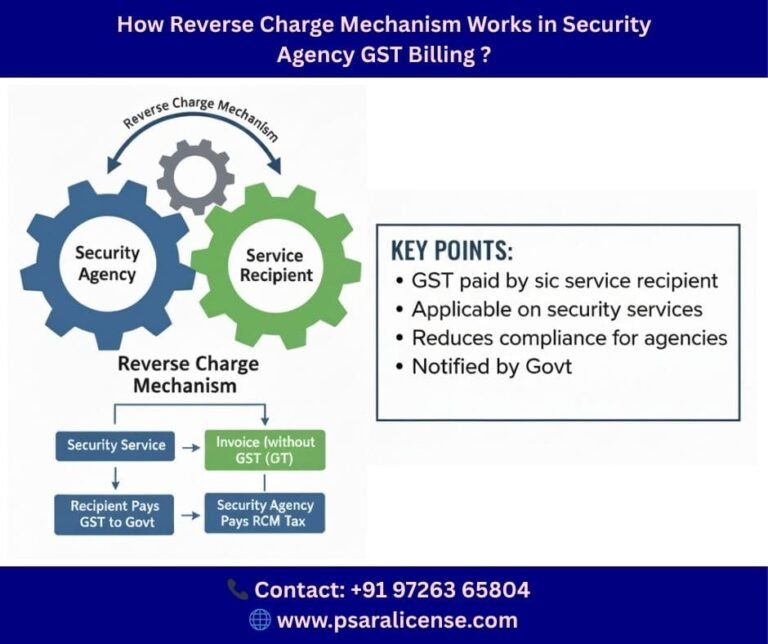

Welcome to our blog on How Reverse Charge Mechanism Works in Security Agency GST Billing! If your business hires security services, under GST’s Reverse Charge Mechanism (RCM), you—the service recipient—are responsible for paying the tax directly to the government, instead of the security agency collecting it. This means the agency provides the service without charging GST, and you must calculate and remit the tax. Understanding RCM helps you prepare accurate invoices, avoid penalties, and claim input tax credit (ITC) smoothly, ensuring your business stays compliant, transactions remain transparent, and your accounts are well-organized without any hassle.

Understanding Reverse Charge Mechanism (RCM) in GST

The Reverse Charge Mechanism (RCM) is a special rule under GST that shifts the responsibility of paying tax from the service provider to the recipient of the service. This is usually applied when the service provider is unregistered under GST or belongs to categories that are exempt from collecting tax. In simple terms, if your business hires a security agency that doesn’t charge GST, it becomes your responsibility to pay the tax directly to the government. This ensures that GST compliance is maintained even when the supplier cannot collect tax, keeping your business on the right side of the law.

For security services, RCM ensures that GST is still collected and deposited even if the agency providing the service cannot do it. It also allows businesses to claim input tax credit (ITC) for the GST paid under RCM, reducing overall tax liability. Following RCM rules helps businesses maintain accurate financial records, avoid penalties, and streamline accounting processes. By understanding how RCM works, you can ensure smooth transactions with security service providers and stay fully compliant with GST regulations.

Difference Between Forward Charge and Reverse Charge

When it comes to GST, knowing whether to use Forward Charge or Reverse Charge is very important, especially for businesses hiring security services. Applying the correct mechanism ensures proper billing, compliance with GST laws, and the ability to claim input tax credit without issues.

Aspect | Forward Charge | Reverse Charge |

|---|---|---|

| Who Pays GST | Supplier collects GST from the recipient | Recipient of the service pays GST directly |

| Invoice | Supplier includes GST in the invoice | Supplier may not charge GST in the invoice |

| Responsibility | Supplier deposits GST to the government | Recipient deposits GST to the government |

| Applicability | Standard GST transactions | Services from unregistered or exempt suppliers, e.g., security services |

| Impact on ITC | Recipient can claim ITC on GST paid to supplier | Recipient can claim ITC on GST paid directly under RCM |

| Example | A vendor selling office stationery charges GST to the buyer | A business hiring a security agency pays GST directly to the government under RCM |

| Compliance Importance | Easier for businesses as supplier handles GST collection | Requires the recipient to track, calculate, and pay GST correctly |

Why RCM Applies to Security Services ?

Security services fall under the Reverse Charge Mechanism (RCM) provisions of GST because many security agencies are small-scale or unregistered businesses. Without RCM, GST on these services might go uncollected, leading to gaps in compliance and potential revenue loss for the government.

Under RCM, the recipient of the service is responsible for paying GST directly to the government, even if the agency providing the service does not charge it. This ensures that tax is collected efficiently, prevents tax evasion, and keeps business transactions transparent.

For businesses hiring security services, understanding RCM is essential to issue correct invoices, maintain proper accounting records, and claim input tax credit (ITC) on the GST paid. It also helps avoid penalties, late fees, and legal complications. By following RCM rules, companies can manage their GST obligations smoothly, ensuring compliance while building trust with service providers and maintaining seamless financial operations.

Who Pays GST Under RCM in Security Agency Business ?

Under the Reverse Charge Mechanism (RCM) for security services, the responsibility to pay GST lies with the recipient of the service. Here’s a simple and user-friendly breakdown:

Businesses Hiring Security Services

Any company, firm, or organization that hires a security agency is responsible for paying GST under RCM. This applies regardless of whether the security agency is registered under GST or not.Government Departments and Public Authorities

If a government department or similar entity avails security services, they too must pay GST directly under RCM. This ensures consistent tax collection across all sectors.Security Agency’s Role

The security agency does not collect GST from the client under RCM. However, they must issue a proper invoice clearly mentioning that GST is payable under RCM, helping the recipient comply easily.Importance of Compliance

Correctly following RCM rules allows businesses to claim input tax credit (ITC), avoid penalties, and maintain proper accounting records. It also reduces the risk of tax disputes or audits, ensuring smooth financial operations.

GST Rates Applicable to Security Agencies Under RCM

Security services are subject to the Reverse Charge Mechanism (RCM) under GST, which means the recipient of the service is responsible for paying the tax directly to the government. As per the latest GST provisions, the applicable GST rate for security services is 18%.

Breakup of GST under RCM:

Intra-State Supply (within the same state):

9% CGST (Central GST)

9% SGST (State GST)

Inter-State Supply (between different states):

18% IGST (Integrated GST)

Key Points to Note:

The security agency does not collect GST under RCM but must issue an invoice clearly stating that GST is payable under RCM.

The recipient must calculate and pay the GST directly to the government.

Businesses can claim Input Tax Credit (ITC) on the GST paid under RCM if the services are used for business purposes.

Compliance with RCM rules ensures accurate accounting, avoids penalties, and maintains transparency in financial transactions.

Inter-State vs Intra-State RCM Rules

When paying GST under the Reverse Charge Mechanism (RCM) for security services, the rules depend on whether the service is provided within the same state or between different states.

1. Intra-State Supply (Same State):

The business hiring the security service pays the GST.

GST is split into 9% CGST (central tax) and 9% SGST (state tax), making a total of 18%.

The security agency should clearly mention the place of supply and note that GST is payable under RCM on the invoice.

Businesses can claim Input Tax Credit (ITC) on the GST paid under RCM if the services are used for business purposes.

2. Inter-State Supply (Different States):

The business hiring the service pays 18% IGST (Integrated GST) directly to the government.

The invoice must show the place of supply, IGST rate, and that RCM applies.

Correct reporting helps avoid penalties, interest, or legal issues during GST audits.

RCM Invoice Format for Security Agencies

When issuing invoices under the Reverse Charge Mechanism (RCM) for security services, it’s important to follow proper GST rules to ensure compliance. Here’s what a correct RCM invoice should include:

RCM Declaration: Clearly mention on the invoice that “GST to be paid by recipient under RCM”. This informs the client that they are responsible for paying the tax.

Agency Details: Include the name, address, and GSTIN of the security agency providing the service.

Recipient Details: Include the name, address, and GSTIN (if registered) of the business or organization receiving the service.

Service Description: Provide a clear description of the security service, including the type of service and the period for which it was provided.

Invoice Number and Date: Ensure the invoice has a unique number and the correct issue date following GST norms.

GST Amount: Mention the taxable value and GST rate (CGST + SGST for intra-state or IGST for inter-state) along with the total GST amount payable by the recipient.

Filing Returns and Claiming Input Tax Credit (ITC)

When a business hires security services under the Reverse Charge Mechanism (RCM), it must pay GST directly to the government. The good part is that this GST can be claimed back as Input Tax Credit (ITC), provided the services are used for business purposes. ITC helps reduce your overall GST liability and keeps your cash flow healthy.

To claim ITC properly, businesses should follow these steps:

Pay GST under RCM – First, the recipient must pay the GST amount while filing their return.

Report in GSTR-3B – The GST paid under RCM must be shown under both “Output Tax Liability” and “Input Tax Credit” in Form GSTR-3B.

Reflect in GSTR-1 – Ensure the transaction is also reported correctly in Form GSTR-1 for transparency and record-keeping.

Keep Proper Invoices – Always maintain RCM invoices that clearly mention “GST payable under RCM”, as these are required to claim ITC.

Common Mistakes Security Agencies Make with RCM

Charging GST in the invoice instead of leaving it to the recipient.

Not mentioning the mandatory clause “GST to be paid under RCM” on the invoice.

Issuing invoices without complete details like service description, period, GST rate, and place of supply.

Clients forgetting to pay GST under RCM, leading to penalties and interest.

Businesses missing the Input Tax Credit (ITC) claim in GSTR-3B after paying GST.

Poor record-keeping of RCM invoices and payments, causing issues during audits.

Penalties for Non-Compliance with RCM

Not following RCM rules properly can create both legal and business problems. Security agencies and their clients should be careful, as even small mistakes in invoices or GST payment may lead to notices from the authorities. Below are the common penalties and risks:

- Late Payment of GST – If GST under RCM is not paid on time, the recipient will have to pay 18% interest per year along with late fees until the payment is cleared.

- Wrong Invoice Format – Issuing an invoice without the RCM clause or wrongly charging GST can invite notices, penalties, and unnecessary disputes with GST officers.

- Loss of ITC (Input Tax Credit) – Clients may lose the chance to claim ITC if RCM tax is not reported correctly, which increases their overall tax burden.

- Audit & Scrutiny Risk – During GST audits or compliance checks, wrong RCM entries can cause unwanted complications and fines.

- Business Impact – Agencies that do not follow RCM rules may lose client trust. Businesses usually prefer agencies that provide clear and compliant invoices.

Benefits of RCM Compliance for Security Agencies

Following RCM rules properly is not just about avoiding penalties – it also gives long-term business advantages to both security agencies and their clients. Here are some key benefits:

Builds Strong Client Trust – Corporate clients prefer agencies that issue correct RCM invoices because it saves them from compliance issues.

Smooth GST Credit Flow – Proper invoices make it easy for clients to claim Input Tax Credit (ITC), which improves cash flow.

Avoids Penalties & Notices – Correct compliance ensures there are no fines, late fees, or notices from GST authorities.

Improves Business Reputation – Agencies that follow GST rules are seen as professional and reliable, which helps win more contracts.

Competitive Advantage – Many small agencies ignore compliance; being fully GST-compliant makes your agency stand out in the market.

Easy Audits & Less Stress – With proper RCM records, audits become smoother and stress-free for both agency and client.

Stronger Long-Term Relations – When clients see no billing or compliance issues, they are more likely to continue working with the agency.

Contact Experts for Hassle-Free GST Billing

Handling GST under Reverse Charge Mechanism (RCM) can sometimes feel confusing, especially when it comes to preparing invoices, filing returns, or claiming Input Tax Credit (ITC). A small mistake may lead to penalties, loss of ITC, or unnecessary notices from GST authorities. That’s why many security agencies and businesses prefer to take help from professionals who understand the rules and ensure everything is done correctly.

By consulting experts, you can save valuable time and avoid errors in compliance. Professionals can guide you with proper invoice formats, accurate GST billing, smooth ITC claims, and timely return filing. This not only makes your agency stress-free but also builds trust with your clients as they receive error-free, compliant invoices.

📞 Contact: +91 97263 65804 | 🌐 www.psaralicense.com